by Jan Roberts

by Jan Roberts

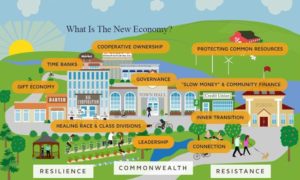

The New Economy is an emerging movement that is taking place largely out of the limelight of conventional media. There is a groundswell of initiatives building an economy that takes care of people and the planet. Systemic changes range from how the economy’s wealth is measured to innovative business ownership designs and economic development approaches. Aspects of the New Economy include:

- The Gross Domestic Product as a measurement for economic success and performance is being challenged by metrics that take into account the wellbeing of citizens and the planet, itself,

- Innovative social enterprises that carefully balance their social mission goals with financial sustainability are becoming a reality across the country.

- The New Economy requires financing, and that financing needs to be managed democratically. Public banks are a way to do that. Diversifying the banking system is challenging but it is moving forward.

- Large community trusts are making a critical difference in the availability of affordable housing and the prevention of the displacement of low income families during neighborhood gentrification.

- Community Development Financial Institutions have expanded significantly to provide services to people and communities that are underserved by mainstream commercial banks and lenders. CDFIs encompass a range of nonprofit and for-profit entities including community development banks, community development credit unions, community development loan funds, community development venture capital funds, and microenterprise loan funds.

- The Creative Economy depends on a person’s individual creativity for its economic value including advertising, architecture, art, fashion, film, music, performing arts and publishing.

- Additional entities in the New Economy are Time Banks and the Sharing Economy.

New Economic Performance Metric

Simon Kuznets, the designer of the Gross Domestic Product GDP in the 1930’s, stated that it was not to be used as a measurement of a nation’s quality of life. He would most likely be discomforted by the oversimplification of the GDP as the bottom line accounting of a nation’s wealth while omitting significant indicators that show the health and wellbeing of citizens, communities and the environment.

Vermont became the first state to pass a law introducing Genuine Progress Indicators (GPI) a new metric for economic success and performance. There are 26 ways the GPI can go up in a state or a nation such as getting more energy from renewables; increased energy efficiency; reducing the income gap; volunteering more for your community; preserving wetlands, forests, and farmland; shorter commutes and transport routes.

In 2014, the first test for applying GPI in Vermont was the five-year economic development plan that tied the state’s economic future to successfully growing the GPI over the next five years. “The overarching goal for this Comprehensive Economic Development Strategy is to increase the Genuine Progress Indicator by 5% over the national baseline by 2020,” states the document. It proposed actions to improve the economic wellbeing and quality of life of Vermonters while “maintaining natural resource and community values.” It laid out specific goals and measurable targets for achieving this mission.

The way forward to grow the GPI in Vermont is still being charted but it began with a public understanding of what the GPI is and how it could improve Vermont’s economy. It is an ongoing process for the public to hold legislators accountable for the enactment of policies that reduce poverty and inequality and improve environmental health.

Vermont is not alone in this quest to implement the GPI. Oregon, Washington State, Colorado, and Hawaii are following Vermont’s example.

Social Enterprise: Evergreen Cooperative in Cleveland

Social enterprises operating at scale create a significant and meaningful number of jobs in a community, achieve the financial sustainability necessary to ride out the lean years and plan for the future, build a diverse and stable customer base, and partner with community organizations to provide a full array of work and social supports for employees.

Evergreen Cooperative in Cleveland is an incubator of large scale social enterprises in Cleveland that are owned by the workers. The Evergreen model draws heavily on the experience of the Mondragon Cooperative Corporation in the Basque Country of Spain, the world’s most successful large-scale cooperative effort (now employing 100,000 workers in an integrated network of more than 120 high-tech, industrial, service, construction, financial and other largely cooperatively owned businesses).

Evergreen Cooperative’s commercial laundry, construction and energy solutions firm, and a hydroponic greenhouse employ residents of the low income neighborhoods surrounding Cleveland’s Greater University Circle District. A unique feature of the cooperatives is their capture of the major purchasing power of the anchor institutions within that district. Across the three businesses, approximately one-third of the revenue comes from contracts with the anchor institutions, including Cleveland Clinic, Case Western Reserve University, and University Hospitals Case Medical Center.

Important to the launch of Evergreen Cooperatives were the Cleveland Community Foundation, the Mayor and City Council, The Democracy Collaborative and the commitment of the anchor institutions.

Evergreen stresses asset building programs for its co-op members. One program is its innovative housing program in its second year. Fifteen employees are in their new homes and paying mortgages, and six more are expected to be buying homes soon. The program is seeded by a grant from the Cleveland Foundation that allows homebuyers to secure no-interest loans on an inventory of newly renovated homes owned by the Cleveland Housing Network in 6 targeted neighborhoods where Evergreen is focusing its hiring and business operations. Mortgage payments are deducted from the employee’s paycheck at a maximum of $400 a month according to a formula that retires the mortgages in five years. Property tax relief is offered to the mortgage holders during that initial five year period. Employees are required to take a series of financial training classes before a mortgage is granted to them.

Another Evergreen asset building program enables coop members to purchase new automobiles at discounted rates so that they have reliable transportation. To date, three employees are in the auto program with another 10 coming into the program in round two.

Evergreen’s cooperative business model is unique in the U.S. and over 100 cities have held round tables on replicating it in their communities.

Video interview with Ted Howard directs the Collaborative’ s partnership with The Cleveland Foundation on the Evergreen Cooperative Business Initiative.

Another Unique Cooperative Just For Fun

Black Star Co-op in Austin is the world’s first cooperatively-owned and worker self-managed brewpub. It is owned by a community of more than 3,000 individuals and organizations, and democratically managed by the Workers’ Assembly. Excellent benefits are given even on the entry level, i.e., a Line Cook earns $12 hour; health and dental benefits; IRA discounts, Paid time off and leadership opportunities.

Black Star Co-op started as an idea for a neighborhood beer bar owned by the community it served. Co-founder Steven Yarak publicized the idea on the internet and on neighborhood fliers. On January 14, 2006, 16 people attended a meeting in an empty lot adjacent to a friend’s house in Austin, TX to learn about the Co-op. Among that initial group was Jeff Young and Johnny Livesay, Black Star Co-op’s eventual first Beer and Kitchen Team Leaders.

Black Star Coop is proud to offer livable wages, democratic workplace; supports local farms; and creates quality products.

Public Banking

The banking industry is not easy to change given its huge lobbying effort and entrenched interests. Government regulations make it difficult for upstarts to gather any momentum. However, efforts do get made and with some success.

The Bank of North Dakota (BND) is a state owned bank and is held up as the flagship for the public banking movement. It has been around for over 90 years and executive roles are staffed by seasoned bankers, not politicians. BND has been benefitting its shareholders, North Dakota residents, with dividends, low cost loans, capitalization of state and community projects and programs with no additional costs, and is a helpful partner to local and community banks. During the 2008 economic crisis, BND suffered no defaults or other financial calamities.

Traditional local banks often fear that state or public owned bank will take their market share. In reality, NDB is an ally to community banks in North Dakota enabling them to participate in larger arenas that are limited by government regulations. For instance, when flooding occurs in a community, BND partners with the local banks to make redevelopment loans covering the risks that regulations demand.

Marc Armstrong, Executive Director of the Public Banking Institute points out: “Public banking is a keystone. Tens of billions of dollars from individual investors and pension funds could flow into local economies if we get this right.”

Washington State has concluded that public banks do not violate its constitution and is moving forward. Santa Fe City Council has approved a feasibility study to establish a city bank. Elected officials in Arizona are exploring a city bank in Tucson or state bank possibilities. Citizens in Colorado have organized to put a referendum for a public bank on the ballot there. In 2015, Public banking occupied legislative agendas and/or local campaigns in Hawaii, Illinois, Arizona, Washington, Colorado, New Mexico, Wisconsin, Illinois, Maine, New Hampshire, Connecticut, and Pennsylvania. The movement goes forth.

Video interview with Ellen Brown, founder of the Public Banking Institute.

Large Community Land Trusts

Community land trusts are nonprofit, community-based organizations designed to ensure community stewardship of land. Community land trusts can be used for many types of development (including commercial and retail), but are primarily used to ensure long-term housing affordability.

In Vermont, the Champlain Housing Trust (CHT), the largest community land trust in the U.S., has over $223 million in assets under its stewardship. The nonprofit develops residential and commercial properties and is charged with producing and maintaining permanently affordable housing – be it rental or homeownership – for low income individuals and families.

Two years ago, Linda and Linwood West were paying the mortgage on their house in Swanton, Linda had a job as a geriatric nurse, and their main concern was her husband’s serious health issues. Then Linda lost her job and the problems began cascading. The couple could not make their payments. Eventually their lender foreclosed on the house. The foreclosure, in turn, tanked their credit rating. Fortunately they learned that CHT had a solution: ReadySetRent, a program that helps people improve their credit so they can qualify to rent.After the couple completed the steps needed to qualify with CHT, they were eligible to rent a spacious apartment on a lake.

In Portland, Oregon, community residents, business owners, nonprofit organizations and university faculty and students are working together to prevent the displacement of low income families in the Cully neighborhood, which is on the cusp of gentrification. Besides the amazing collaborative effort of all including the three nonprofits, that in other places maybe more interested in protecting their turf, innovative strategies such as community land trusts are being used.

Video interview with Jeff Gerwing, Associate Professor at Portland State University, serves on the Community Advisory Board for Cully Neighborhood.

A Community Development Financial Institution Being Innovative

Coastal Enterprises, Inc. is a Community Development Financial Institution with a mission to provide economic development through social justice initiatives that create healthy communities.

Of the 5,300 miles of shorefront in Maine, only 25 miles are still in use for fishing and marine industries. In 2002, Coastal Enterprises, Inc. helped 5 lobster fishermen form The Maine Lobster Cooperative in 2002 and to obtain $380,000 in financing to buy property that gives them guaranteed access to water, a secure place to store boats, traps, supplies and to buy bait collectively. Cooperative Members are local lobster fishermen, who make $30,000 to $50,000 during lobster season. The 24 members and activities of the cooperative support 40 families.

The CDFI helped the cooperative make members’ livelihoods sustainable by putting a working waterfront easement on the property modeled after a conservation easement. This innovative ownership design created by CEI and funded by a state bond program to the tune of $6.7M has resulted in two dozen working waterfronts being preserved on Maine’s coastline allowing hundreds of fishing families to support themselves. The easement is a covenant that attaches permanently to the property deed guaranteeing that the land will always be used for commercial fishing.

The working waterfront easement and a change in maritime rules that allow only lobster fishermen who own their boats fish in waters up to three miles from the coast has preserved the local lobster industry in Maine. . Maine’s 2014 commercial lobster harvest indicate that the industry brought more than $450 million into the state. Much of that value remains in the state, moving among individuals and businesses, supporting local economies. In general, lobstering communities are doing well. Since 1985, annual income from lobster fishing has increased by nearly 400 percent.

Video Interview with Marjorie Kelly, Author and New Economy Advocate, on innovative business ownerships including the CDFI work in Maine.

Creative Economy

The creative industries are becoming increasingly important to economic well-being. Proponents even suggest that human creativity is the ultimate economic resource. In Mississippi, the creative economy is alive and well and grew out of the Blues much to the surprise of legislators, arts administrators and tourism directors.

In 2011, the state funded an extensive survey that found over 60,000 people were employed in the creative economy despite little or no direct support from the state. It was one of the fastest growing creative economies in the country.

The 60,704 employed in the creative economy represented 2.5 percent of the state’s population over the age of 25, according to census data. When the state revisited its study in 2014, they discovered the $955 million contributed by the creative economy represented 3.2 percent of the state’s $101.5 billion gross domestic product.

The Mississippi Development Authority and Mississippi Arts Commission worked with the Minority Business Division and Entrepreneur Center and Mississippi Main Street to provide professional development workshops across the state. The state is increasing its support of the development of the creative economy. An additional $5.1 million for the state’s tourism advertising budget was included for 2016.

Video interview with Mississippi State Tourism Director Malcolm White and State Senator John Hohrn on how the Blues sparked the Creative Economy.

Time Banks and the Sharing or Digital Economy

Time Banks are occurring all over the United States where community residents exchange their skills with others as a means of extending their financial resources. The Portland Hour Exchange in Maine is an example. Video interview with Stephen Beckett, co-founder, who describes how Portland set up their bank and the benefits of it to residents.

The Sharing or Digital Economy has grown by leaps and bounds. It maximizes the value of non-monetary assets and is providing full and part time employment to folks seeking to increase their financial resources. One of the controversies recently in the news is the use of people providing the services as regular or contract employees. or . Examples are Airbnb—Rental spare rooms, homes, castles; yurts, treehouses, lighthouses platform; 17 million guests with 1 million guests every month and Uber—Ride Broker; 70 Cities worldwide. Video interview with Arun Sundararajan Professor of Information, Operations and Management Sciences and a Doctoral Coordinator at the Stern School of Business, NYU.

[ultimate-recipe id=”7029″ template=”101″]